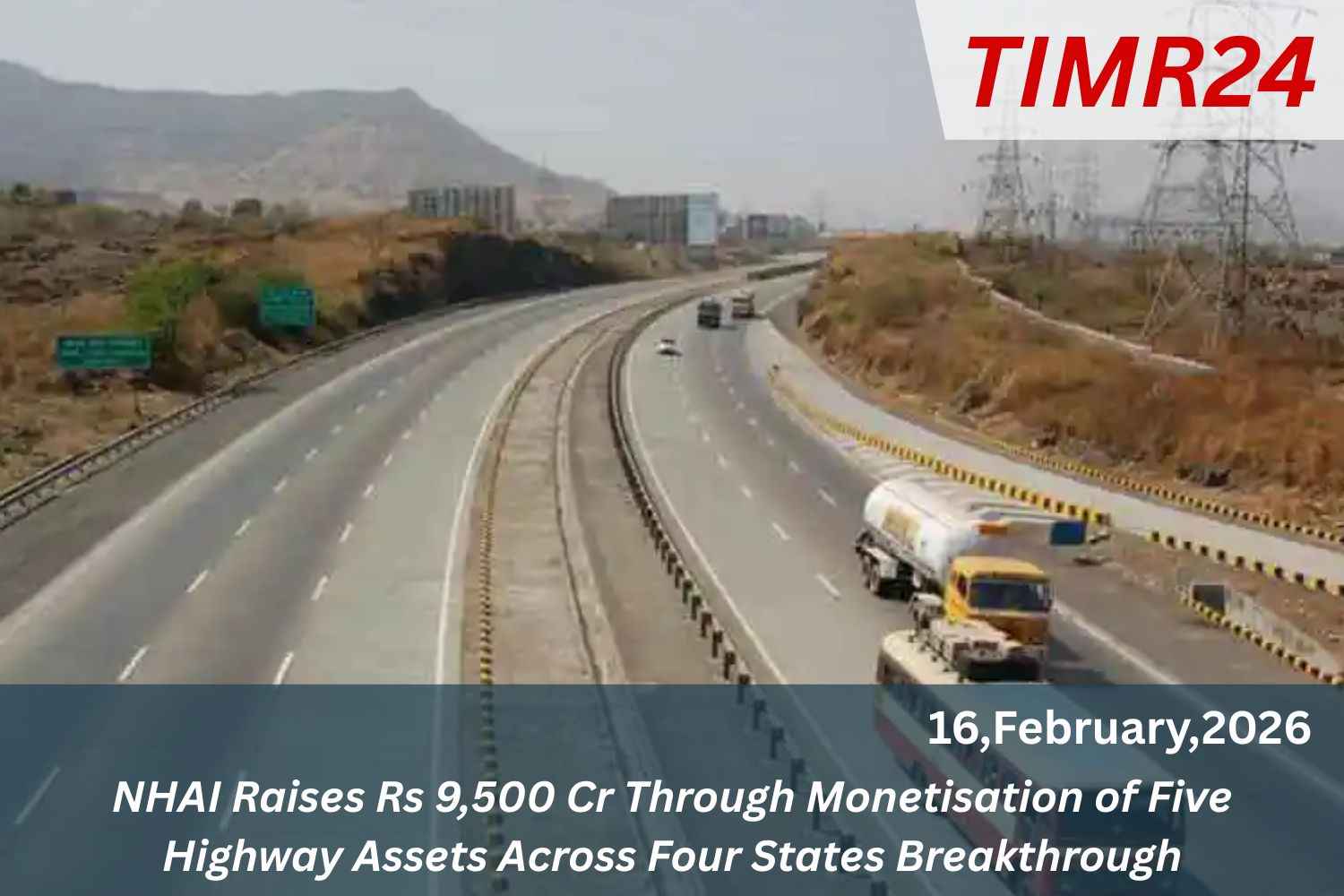

The National Highways Authority of India (NHAI) has obtained approval from the Securities and Exchange Board of India (SEBI) for its Raajmarg Infra Investment Trust (RIIT) to function as a public Infrastructure Investment Trust (InvIT). This clearance paves the way for NHAI to access public markets, enhancing the monetization of national highway assets and providing investment opportunities for retail and domestic investors. The initiative is expected to encourage public participation in national highway infrastructure development and offer stable yield-based investments. NHAI has established Raajmarg Infra Investment Managers Pvt. Ltd. (RIIMPL) as.

National Highways Authority

The investment manager for RIIT, supported by several banks and financial institutions. The chairman of NHAI, Santosh Kumar Yadav, highlighted that this approval is crucial for expanding public involvement in India’s infrastructure growth and will assist in mobilizing long-term capital and improving highway sustainability The National Highways Authority of India has reached a significant milestone in its infrastructure financing strategy after securing approval from the Securities and Exchange Board of India for its proposed Raajmarg Public Infrastructure Investment Trust. This approval marks a critical step in NHAI’s ongoing efforts to.

Unlock value from operational highway assets while attracting long-term institutional and retail capital into India’s road infrastructure ecosystem. As India accelerates its highway expansion under ambitious national programs, innovative financing instruments like InvITs are becoming central to sustaining growth without overburdening public finances. The Raajmarg Public InvIT represents not only a financial innovation but also a structural shift in how public infrastructure is funded and managed At its core, an Infrastructure Investment Trust allows revenue-generating assets to be pooled into a trust structure and listed on stock exchanges, enabling investors to earn.

Regulated And Transparent Infrastructure

Stable returns from toll collections and annuity payments. With SEBI’s approval now in place, NHAI can move closer to launching India’s first fully public InvIT sponsored by a government authority, reinforcing confidence in regulated and transparent infrastructure monetisation. This development aligns closely with the government’s broader asset monetisation roadmap, which aims to recycle capital from mature assets into new project The Raajmarg Public InvIT is expected to include a portfolio of completed and operational national highway stretches that generate predictable cash flows. These assets, developed under models such as Toll-Operate.

Transfer and Hybrid Annuity, provide revenue visibility that is particularly attractive to pension funds, insurance companies, and long-term investors. By placing these assets into an InvIT, NHAI can monetise highways without relinquishing ownership permanently, while still maintaining regulatory oversight. This approach strengthens the balance sheet of the authority and reduces dependence on traditional borrowing, a concern SEBI’s approval also underscores the maturity of India’s capital markets in accommodating complex infrastructure products. Over the past few years, regulatory clarity around InvITs has improved, offering better governance norms, disclosure.

Enhances Credibility And Positions

Standards, and investor protections. For Raajmarg Public InvIT, SEBI’s nod means compliance with stringent requirements related to asset valuation, sponsor commitments, and distribution policies. This regulatory framework enhances credibility and positions the (India) InvIT as a viable alternative investment avenue, particularly at a time when global investors are actively seeking stable yield-generating assets in emerging markets From a macroeconomic perspective, the launch of Raajmarg Public InvIT is likely to have a multiplier effect on India’s infrastructure development. Capital raised through the InvIT can be redeployed into new highway construction.

Accelerating connectivity across industrial corridors, logistics hubs, and rural regions. Improved road infrastructure reduces transportation costs, boosts trade efficiency, and supports regional economic development. These benefits align with India’s long-term vision of becoming a $5 trillion economy, where infrastructure plays a foundational role Investor interest in infrastructure assets has grown steadily due to their inflation-hedged returns and long-term stability. Raajmarg Public InvIT, backed by NHAI’s strong operational track record, is expected to attract both domestic and foreign investors. Institutions such as sovereign wealth.

India’s InvIT Market Could Witness

Funds and global pension funds have already shown interest in Indian InvITs, as seen in earlier highway and transmission InvIT issuances. According to insights shared by market analysts and reported by financial regulators, India’s InvIT market could witness significant expansion over the next decade Raajmarg Public InvIT offers an opportunity to participate indirectly in national infrastructure assets that were previously inaccessible. Listed InvIT units provide liquidity, regular income distribution, and transparency through mandatory disclosures. However, investors must also understand the risks associated with traffic variability, regulatory changes, and interest rate movements.

From a governance standpoint, Raajmarg Public InvIT is structured to ensure professional asset management and accountability. Independent trustees, experienced investment managers, and regular audits form the backbone of the InvIT ecosystem. This professionalisation addresses long-standing concerns about efficiency in public infrastructure management and sets a precedent for other government agencies considering similar monetisation models The approval also sends a positive signal to global markets about India’s commitment to reform-oriented infrastructure financing. At a time when many countries face fiscal constraints, India’s ability to attract private.

Renewable Energy, Potentially Reshaping

Capital into public assets through transparent mechanisms enhances its investment appeal. The Raajmarg Public InvIT could serve as a benchmark for future public-sector InvITs in sectors such as railways, urban transport, and renewable energy, potentially reshaping how infrastructure is (India) funded nationwide the success of Raajmarg Public InvIT will depend on market conditions, asset performance, and investor confidence. Timely listing, competitive pricing, and consistent distributions will be key to establishing trust. If executed effectively, this InvIT could unlock billions in capital, reduce pressure on public borrowing, and accelerate the delivery of critical highway projects.